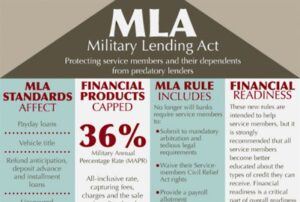

Starting in 2006, the Federal government issues new regulations to protect our active service military personnel and their families. The Military Lending Act was intended to keep unscrupulous “predatory” lenders from taking advantage of our brave soldiers.

Starting in 2006, the Federal government issues new regulations to protect our active service military personnel and their families. The Military Lending Act was intended to keep unscrupulous “predatory” lenders from taking advantage of our brave soldiers.

Lawmakers felt compelled to pass this law when they learned that military personnel take out payday-style loans at more than twice the national average.

What Does the Military Lending Act Do?

The main tenants of the MLA:

- The MAPR (Military Annual Percentage Rate or Military APR) is capped at 36% for consumer loan products. This includes many kinds of loans and lines of credit. Military personnel may NOT be charged more than 36% of the borrowed sum over the course of a year in any circumstances.

- The shady practice of prepayment penalties is banned for service members. They may not be financially punished for paying a loan off early.

- Lenders can’t force military personnel into arbitration, or in any other way to surrender any legal rights.

These laws apply (but are not limited to) the following: Payday loans, cash advances, overdraft lines of credit, tax advance loans, direct deposit loans, title loans, installment loans, credit cards.

These laws do NOT apply to mortgages, home equity loans, car loans, or student loans.

Who Does it Protect?

The Military Lending Act protects all active duty members of the Army, Navy, Air Force, Marine Corps, and the Coast Guard (if they are serving for more than 30 days). Service members on active or reserve National Guard duty are also covered.

The MLA also offers the same protections of the immediate families of service members. Children and dependents younger than 21, and full-time students younger than 23. Incapacitated dependents of any age are also covered.

If you would like to find more information about these laws, follow this link to the MLA Database.